When you become an employer, there are many obligations you become responsible for. One area that catches a lot of employers unaware is payroll tax and it raises many questions for employers such as:

- Are you aware of your payroll tax obligations for each state you operate in?

- Are you registered for payroll tax? Do you need to be?

- Did you know that state revenue departments have the power to group directors, shareholders, and other entities under their control with the employing entity and may be held liable for unpaid payroll tax and enforcement penalties?

If you are unsure of the answers to the above questions you need to read on.

What is Payroll Tax?

Payroll tax is a state tax levied on wages paid by an employer to its employees.

It is a state-regulated tax, with each state and territory of Australia having unique rates, thresholds and registration requirements. These requirements vary according to the employer, the amount of wages paid, and whether the employer operates interstate.

To better understand payroll tax and its implications, this article will take a closer look at:

- legislative provisions of each state and territory, that employers should be aware of; and

- state revenue departments’ power to group employers with related entities and issues that may arise for employers.

Legislation

In 2010, each state signed a protocol to harmonise payroll tax legislation across Australia. The protocol aims to design, implement and maintain an administrative framework for payroll tax harmonisation amongst all jurisdictions.

The following states have enacted identical payroll tax legislation, apart from minor differences in the schedules of that legislation:

- New South Wales;

- Victoria;

- Tasmania;

- Northern Territory; and

- South Australia.

(the Uniform Acts)

The remaining states have similar payroll tax provisions, pursuant to the protocol, but do not have identical pieces of legislation like the Uniform Acts.

Liability for payroll tax

Payroll tax legislation provides that:

- payroll tax is levied on wages paid or payable by an employer to its employees;

- liability to pay payroll tax is triggered when the total taxable wages of an employer (or group of employers) exceed a threshold amount; and

- the threshold amount is the total taxable wages of an employer (or group of employers) paid or payable across all states of Australia.

If the threshold amount is exceeded, then that employer (or group of employers) is liable to pay payroll tax in the relevant state.

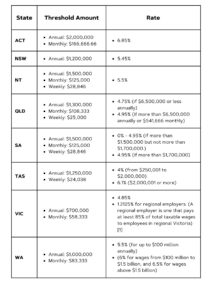

The threshold amount, and rate of payroll tax, vary amongst the states and are set out in the table below.

Payroll Tax Groupings

Under part 5 of the Uniform Acts, and similar provisions in the Western Australian2, Queensland3 and Australian Capital Territory4 payroll tax legislation, entities may be grouped for payroll tax purposes where:

- the entities are corporations related to each other by virtue of section 50 of the Corporations Act 2001 (Cth) (the Corporations Act). That is, where entities are holding companies or subsidiaries of each other;

- an entity carrying on a business shares at least one employee, and that employee performs duties for or in connection with a business carried on by another entity;

- a person or persons have a controlling interest in two businesses. Generally, a controlling interest is 50% or more voting power in connection with:

(a) meetings of the board; and/or

(b) meetings of shareholders;

of the employing entity carrying on the relevant business; and/or

4. an entity has a controlling interest in a corporation. The corporation need not carry on a business to be grouped. ‘Controlling interest’ has the same general meaning as described above.

When you need to register for payroll tax

The table below summarises the requirements to register for payroll tax in each state and territory.

Example

The following example may help explain when payroll tax applies and when employers and their related entities may be liable for each other’s payroll tax debts. This example is based on the following hypothetical facts.

Jack is the sole shareholder and director of:

- Employer Pty Ltd – which carries on a business operating a host of cafés in South Australia; and

- Company A Pty Ltd – which carries on a consultancy business operating in Victoria.

Jack’s understanding was that Employer Pty Ltd is, and always has been, under the $1.5 million threshold requirement to pay payroll tax in South Australia. For this reason, Employer Pty Ltd has never been registered for payroll tax and never paid any payroll tax.

Jack received a notice from the Department of State Revenue South Australia (Revenue SA) stating:

- Employer Pty Ltd is grouped with Company A Pty Ltd because Jack has a controlling interest in each of the companies’ businesses;

- Employer Pty Ltd and Company A Pty Ltd’s collective wages exceeded the payroll tax threshold each year for the past 10 years;

- Employer Pty Ltd is liable for $300,000 in unpaid payroll, penalty tax and interest. (Outstanding Payroll Tax).

Impact on Jack and his companies

Under payroll tax legislation, Employer Pty Ltd is grouped with:

- Jack, because of his controlling interest in Employer Pty Ltd, having more than 50% of voting power in his shareholding and directorship; and

- Company A Pty Ltd, because it and Employer Pty Ltd are ‘commonly controlled businesses’ by nature of Jack’s sole shareholding and directorship in each.

Employer Pty Ltd, Company A Pty Ltd and Jack are jointly and severally liable for the Outstanding Payroll Tax and any of their bank accounts may be garnished by Revenue SA to recover the Outstanding Payroll Tax.

Summary

As you can see from the above example, failure to understand an employing entity’s obligations under payroll tax legislation may lead to the accrual of considerable tax liabilities over time. Such liabilities, that may arise following an audit or sudden issue of a payroll tax notice by a state revenue department, are likely to adversely affect the employing entity’s liquidity or even its solvency.

The state revenue departments’ broad powers to group associated entities and garnish bank accounts breaks down the corporate veil and protections afforded under limited liability of corporations.

The flow-on effect of payroll tax groupings is that directors and shareholders may be financially affected by the decisions of a separate employing entity. There may be negative ramifications for individuals, their families and businesses run by the associated entities and their stakeholders.

If the above does not entice employers to consider whether they are up to date with their payroll tax obligations and whether associated entities are at risk, I’m not sure what will. It is important to get it right or you may end up at the mercy of state revenue departments.

1 Payroll Tax Act 2007 (VIC) s 3A.

2 Pay-roll Tax Assessment Act 2002 (WA) Part 4.

3 Payroll Tax Act 1971 (QLD) Part 4.

4 Payroll Tax Act 2011 (ACT) Part 5.

5 Payroll Tax Act 2011 (ACT) s 86.

6 Payroll Tax Act 2007 (NSW) s 86.

7 Payroll Tax Act 1971 (Qld) s 52.

8 Payroll Tax Act 2009 (SA) s 86(1).

Tagged in: payroll tax, Payroll Tax Act, Payroll Tax Act 1971